V1) Non Modified All Weather https://bit.ly/3dF23GI

- Long Bonds, Intermediate Bonds, Gold, Commodities, Stocks

V2) Sam's Modified All Weather https://bit.ly/3vau8vC

- swapped SP500 for Constellation Software

- swapped commodities index for Texas Pacific Land Trust

- swapped Gold for Bitcoin!

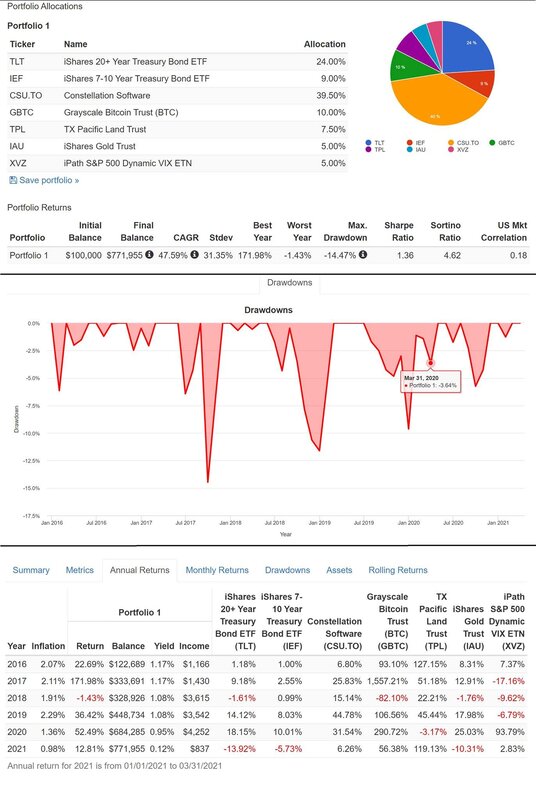

V3) Dragon Portfolio Inspired https://bit.ly/3dL0do1

- added gold back in,

- added long vol,

- increased the stock portion and

- decreased bonds equally by 40%

RSS Feed

RSS Feed