Its the result of three decades of Ray Dalio ( one of the greatest hedge fund managers in the history of investing) learning how to invest in the face of uncertainty and that can perform well across all different types of economic environments

.

The bonus is that Its also Tax Deferred inside an RRSP allowing for more compounded growth and Management Expense ratios of 0.05%. to 0.40 (This is 95% lower than the average expense ratio of funds with similar holdings.*)

`

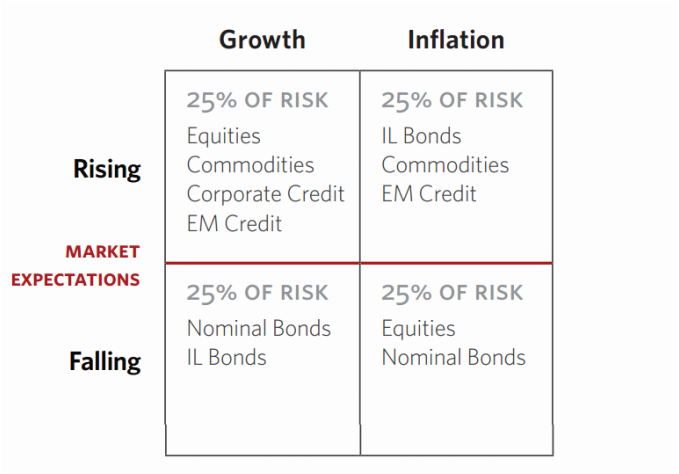

1. Inflation

2. Deflation

3. Rising economic growth

4. Declining economic growth

And there are only four different possible “environments,” or economic “seasons,” that will ultimately affect whether investments (assets prices) go up or down (except unlike nature, there is not a predetermined order in which the seasons will arrive):

1. Higher than expected inflation (rising prices),

2. Lower than expected inflation (or deflation),

3. Higher than expected economic growth, and

4. Lower than expected economic growth.

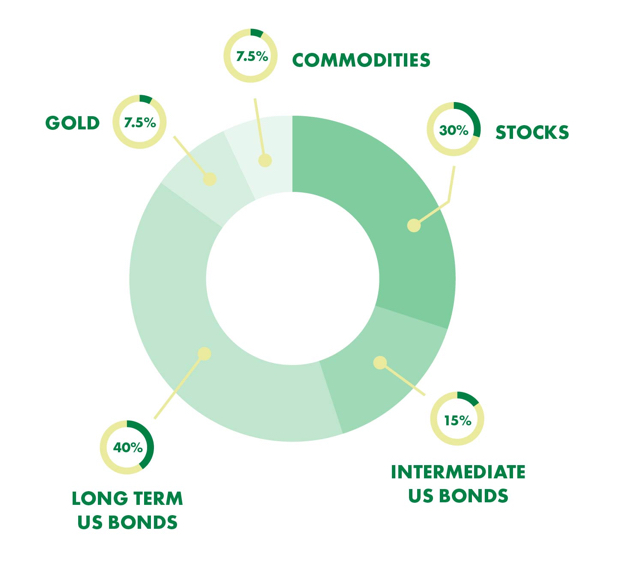

1. Just under 10% (precisely 9.72%, net of fees) average annualized return.

(It’s important to note that this is the actual return, not an inflated average return.)

2. You would have made money just over 86% of the time. That’s only four down/negative years. The average loss was just 1.9% and one of the four losses were just 0.03% (essentially a break-even year)—so effectively you would have lost money only three out of thirty years.

3. The worst down year was -3.93% in 2008 (when the S&P 500 was down 37%!)

4. Investor Nerd Alert: Standard deviation was just 7.63% (This means extremely low risk and low volatility.)

Although the past results do not guarantee future results its a good place to start.

- Sam Kakembo

"Turning Ideas Into Reality. Daily"

Related Posts

The House Has The Edge

How Ted Johnson, Ex-UPS Employee Banked $70 Million

source: http://yahoofinance.tumblr.com/post/102956492899/tony-robbins-ray-dalios-all-weather-portfolio

RSS Feed

RSS Feed