There are a million ways in order start walking on the path to complete financial freedom. Today I will cover some of the most researched strategies set out by some of the worlds greatest investors to help the average person achieve financial freedom.

1) Control your own investments. Get a Self Directed brokerage account at Questrade.com

Questrade allows you so sign up online and build your own investing portfolio. You can and make regular deposits into your investment account via online banking or bill pay. The software is quick, efficient , paperless and can easily be accessed on your smart phone so you can invest on the go.

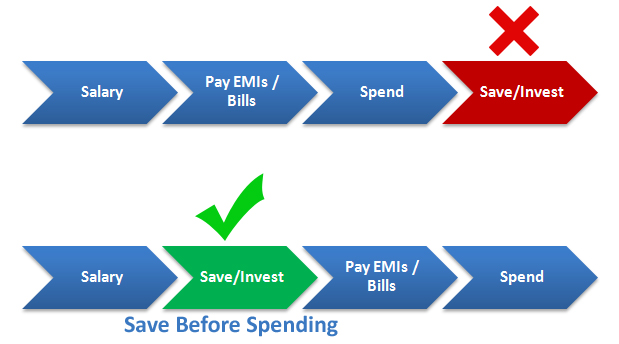

2) Pay yourself first

You have two options when setting up a pay yourself first system, you can speak to your HR department at work and get a second deposit account connected or you can set up automatic bill payments every month via online banking. You may start off with a small percentage of saving like 5% and gradually move towards at least 20% of every payment you receive. Having the luxury of cash gives you the opportunity do things like purchase a business for yourself, or property with an income suite to be able to live for fairly cheap.

There is an example of a girl in new york who saved 70% of her income and was able to retire at the age of 28. You can check out her blog here. Deciding to become an owner and invest is the single greatest decision you can make as a young person because in investments time is the greatest asset.

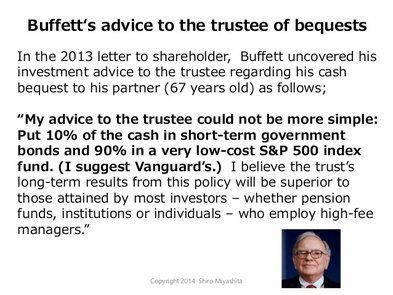

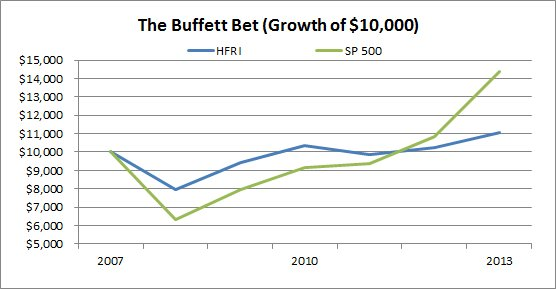

3) Buy the market, vs trying to beat the market picking stocks

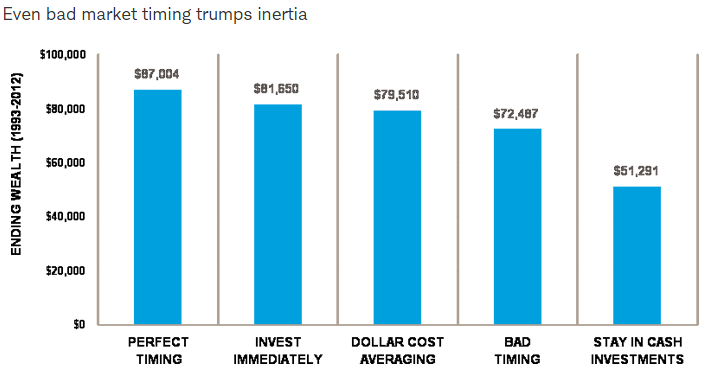

4) Buy right away, time in the market is better than trying to pick the right time

One of the common questions for investors is "is this the right time to invest? should I buy now or wait for a market crash to buy" The answer is simple, even the greatest investors in the world have no idea which direction the market is going to move so so its best to start right away and consistently make purchases of the market over long periods of time vs waiting for the right time. Cash has always been the worst performing asset because inflation makes the purchasing power of cash decrease each year.

- Peter Perfect was a perfect market timer. He had incredible skill (or luck) and was able to place his $2,000 into the market every year at the lowest monthly close.

- Ashley Action took a simple, consistent approach: Each year, once she received her cash, she invested her $2,000 in the market at the earliest possible moment.

- Matthew Monthly divided his annual $2,000 allotment into 12 equal portions, which he invested at the beginning of each month. This strategy is known as dollar cost averaging.

- Rosie Rotten had incredibly poor timing—or perhaps terribly bad luck: She invested her $2,000 each year at the market's peak, in stark defiance of the investing maxim to "buy low."

- Larry Linger left his money in cash investments (using Treasury bills as a proxy) every year and never got around to investing in stocks at all. He was always convinced that lower stock prices—and, therefore, better opportunities to invest his money—were just around the corner. Refrence: Charles Schwab Study

Follow these simple strategies and you will put yourself in the right path to financial freedom. See you there.

RSS Feed

RSS Feed