BECOME THE INSIDER: KNOW THE RULES

BEFORE YOU PLAY THE GAME

The uncomfortable truth is that the entire financial system system rigged and designed to:

Let’s briefly examine the evidence in the 13 Trillion Dollar Mutual Fund Industry, the world’s largest and most important retirement investment system:

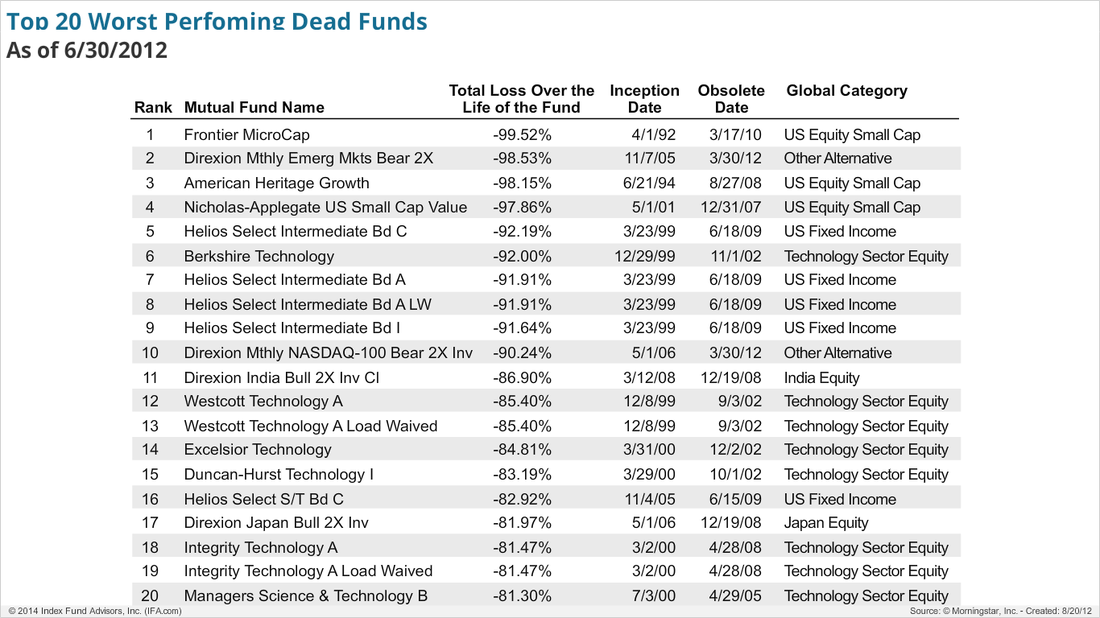

The Center for Research on Securities Prices (CRSP) at the University of Chicago has the only complete database of both live and dead mutual funds. The CRSP database includes approximately 39,000 mutual funds from 1961 to 2012. In that time, approximately 13,000 of the 39,000 mutual funds died. That means that more than 33% percent of mutual funds data is not included in the average returns of active managers. The active managers who run them happily bury most of the data about dead funds. Is it possible that the 13,000 dead mutual funds had high returns for their investors? "The game is still winnable" - Ray DalioBut to win, you have to know the rules and learn the best strategies for success from those who have already mastered the game.

The good news is that you can save years of time—and in a few minutes—by simply learning the pitfalls to avoid and the shortcuts to experiencing lasting success. The financial industry often works to make this topic feel incredibly complex, but in reality, once you get past the jargon, it’s relatively simple. This book is your opportunity to stop being the chess piece and become the chess player in the game of money.” Theodore Johnson, a man who never earned more than $14,000 a year, using a simple concept of automated saving, (20% of his pay cheque) and the power compounding interest had $70 Million at retirement. THE RULES OF THE GAME: Getting Started

The Platinum Rolodex of Financial Wizards

Some of the top minds and leaders in the world of finance were interviewed to decipher 'how the game is really played'. These modern money masters include:

Learn and Master: The Rules Of The Game |