Most large cap Canadian/American businesses are flush with cash and waiting. Currently the money is best spent doing stock buybacks & mergers/or Acquisitions. Now lets visit some core trends in financial markets:

Making money in the financial markets is a Zero sum game.

• For you to win someone else has to lose.

• For you to buy, someone else has to sell,

• 95% of traders lose money

• 90% of active mutual funds under-perform the S&P 500 index

| Risk Parity |

The most important thing to focus on is having a well diversified investment portfolio. The best diversification is with selecting your r Asset Allocation (% stocks, bonds, gold, commodities)

| When you consider how most markets work |

The problem with most markets is you cant achieve balance.

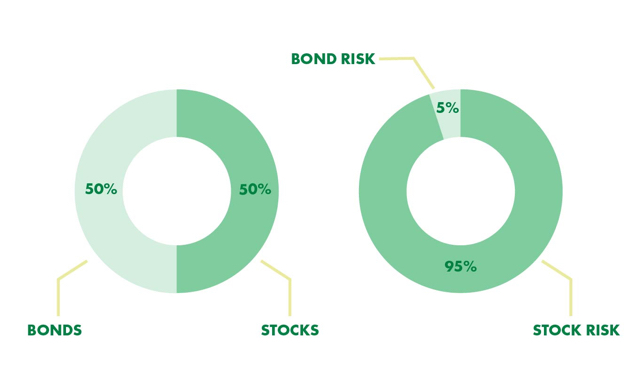

Say you want to diversify, using a 50/50 balance,

• 50% stocks,

• 50% bonds.

Your portfolio is dominated by equities, because stocks are three times more volatile (risky) than bonds. That means if your stocks drop, the whole portfolio drops. A traditional solution is to buy more bonds, but as you buy more bonds, you are buying a lower returning asset class. The more you buy of the lower returning asset class, you dilute your returns and you're not getting much growth. So in order to properly balance your portfolio and maximize returns without increasing risk you have to balance your risk across asset classes.

Those who have riskier assets tend to have the higher return, and greater highs/lows (volatility) Which scares people out of the market, usually at the wrong time (buy high sell low). The volatility in stocks is because the average company in the S&P 500 is using considerable amounts of debt to expand.

( avg Debt to income ratio 1:1 for S&P 500 Companies)

| All Weather Portfolio |

By levering the bonds you get to have more bond exposure in your portfolio.

This will increase the return of the bonds, and create diversification with out lowering your rate of return. (noting the return of bonds are greater than cash)

| We must focus on diversifying between asset classes because: |

• we still don't know what the market is going to do for the next 10 years

• we don't know which asset is going to be the better return,

• asset classes can have similar expectations,

• assets can similar expected risk AND,

It does not lower your returns to diversify. It makes the ride more smooth so you can stay in the market long enough for your returns to compound.

Chief Investment Officer

GSK Wealth Builders

~ Turning Dreams Into Reality, Daily! ~

For more on this topic CLICK HERE to see other blog post on the All Weather Fund

RSS Feed

RSS Feed