|

This is Cash Flow Superstore by GSK Wealth Builders.

Let me walk you through the 3 steps required to get started with building a passive income stream. STEP 1 - Get to know our team We have partnered with one of the largest passive income providers with over 5,000+ properties being managed.

Each one started with an investor watching the following links to learn how the Buy and Hold system works. This is the most time that you will devote to your passive portfolio - education. Plan on spending about 4 Hours per year on your passive income... Take time and watch these videos... www.FortuneBuilders.com/VirtualBuyingTour - A FAQ website we put together to answer many of the questions our partners typically have that introduces you to our largest inventory provider and property management team. http://www.passiveincomeclub.com/videoseries/day-five.php - This webinar describes how we use accelerated cash flow to reach $21,000/month passive income STEP 2 - Property Overview

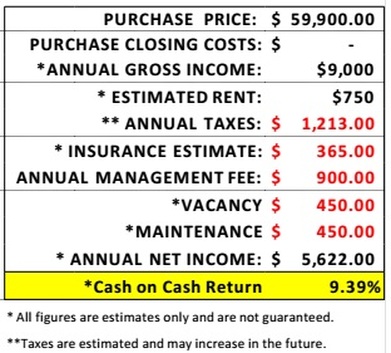

***sample inventory properties; these are an example of the numbers we look for on properties that we would be putting into our portfolio. Subject Property 1 | 7218 E 34th Street, Indianapolis IN 46226

- Tax Estimate 2015

|

|

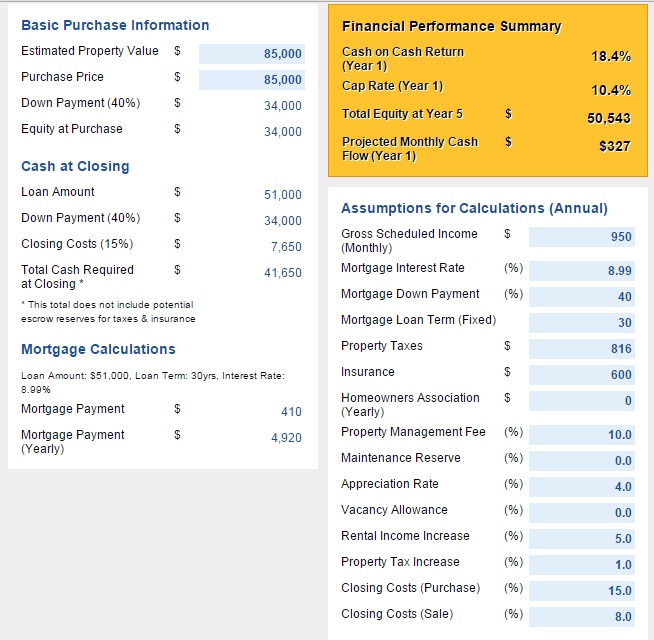

35% Down

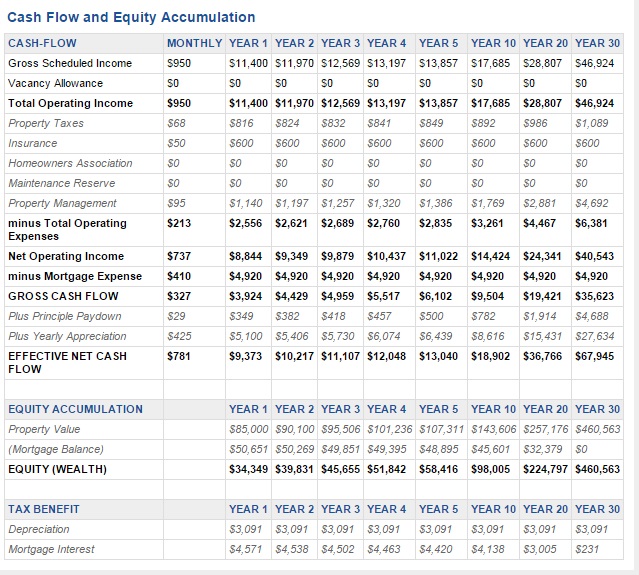

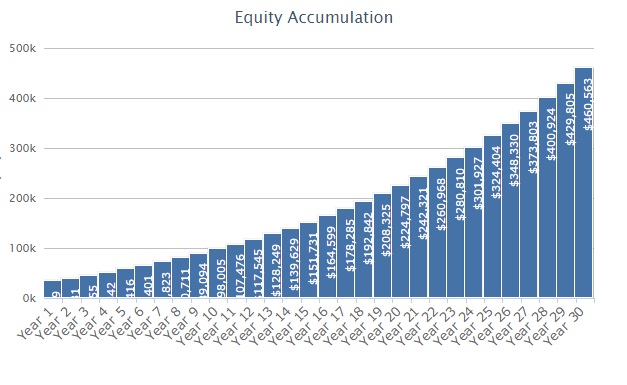

ex 5 houses 27k down x 5 = 135k down after 5 years, 2 houses paid off worth 80k each = house value 405,000 Total equity 293,000 after 3 remaining mortgages paid off - 135000 initial down payment = 158k x.6 = 94,800 profit 70% ROI in 5 years or 14% annual monthly cashflow is now $1,781 or $21,372 @13 houses, you pay off a mortgage every year cash flow 1515 applied to mortgage 1 |

50% down

First house paid off 1 year 7 months New cash flow $1756/mth | $21,072/year 2nd house balance $29,521 2nd House paid off 1 year 5 months (year 3) new Cash flow $1997/mth | $23,964 3rd house balance $29,275 3rd House paid off 1 year 3 months (year 4.3) new Cash flow $2,238/mth 26,856 4th house balance 29,007 End year 5, 4th house balance = $13341 (6mos) Total debt $42,241 | Total Assets 407,465 |Equity $365,000 new cash flow if extended past 5 years 2479/mo |$29,748/yr 4th house paid off in year 5.5 5th house balance = $28,774 5th house paid off in year 6.5 Down payment $175,000 | Net profit 190,000 Yr 6.5 new cash flow all free and clear 2,720/mo |$32,640/yr Equity 425,000 |