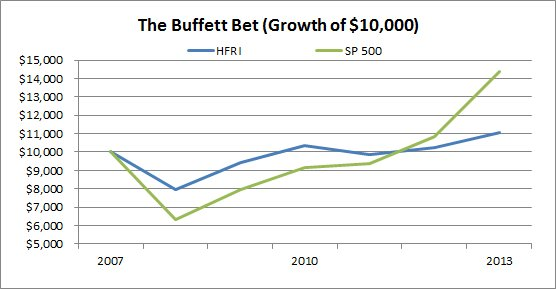

| "The house has the edge" - Steve Wynn When you goto invest your money ask yourself this,are you funding your retirement or someone else's? Isint it crazy that owning just one Index fund in the S&P 500 over time you are already beating 96% of mutual funds and "top" hedge fund managers? Warren Buffet even made a bet against anyone in america that the index fund will out perform any selected the hedge fund managers over a 10 year period, so far hes up 43%, the fund up 10%. WOW! |

Want more information like this?

Input Variables Total Needed = Expenses x Years Retired x 1.25 percent (tax) Shortfall = Total Needed - Current Retirement Savings Yearly Savings Shortfall / years retired Monthly Savings = Yearly Savings / 12 months Assumptions Avg 2 Family Home Cashflows $500/month net Downpayment $25k to Hold or Rehab for $30,000 profit Formula Monthly Expenses = Yearly Expenses / 12 Units Needed = Monthly Expenses / Cashflow Capital Needed = 25k x Units Needed Rehabs to complete = Capital needed / $30,000 Total Rehabs / 5 years Every 20 offers = 1 Deal Rehabs x offers = amount of offers Example (always round up) Yearly Expenses $60,000 Monthly Expenses $5,000 Cashflow $500 Units needed = Monthly Expenses / Cashflow Units needed = 10 Properties Capital needed $25k x 10 = $250k $250k/30,000 = 9 Rehabs 9 Rehabs/5 years = 2 rehabs per year If you can rehab 2 properties per year, you can retire in 5 years with an income of $60,000/year Difference = Shortfall / Capital Needed Sam Kakembo ~ Keeping Dreams Alive ~ P.S. This is how I did it. Warning: don't watch it unless you're prepared to get in, now. P.P.S. Checkout our income disclosure while you're at it - here. Again, click here - watch the hangout and leave me your thoughts in the comments.

|

AuthorGSK Wealthbuilders is known as the most sought after Social Media Marketing, Visual Design, and Real Estate and consultanst in the online business community. Categories

All

Archives

May 2021

|

RSS Feed

RSS Feed